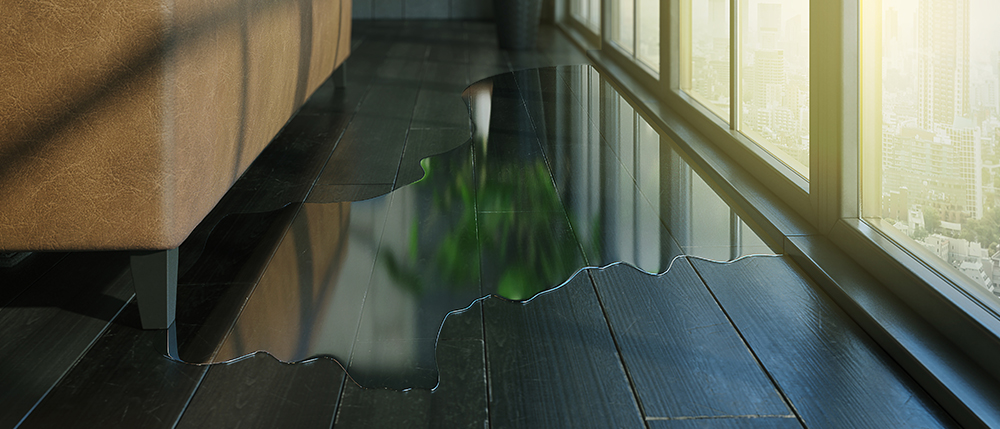

Engle Martin’s Specialty Loss Group (SLG) team offers expert perspectives on the frequency, severity, and other considerations contributing to significant loss/deductible dollars related to water losses.

Problem – Water related losses arise from either natural flooding events or interior water damage claims. Flooding events appear to be happening more frequently which effect all occupancies and can result in claim severity. In our experience, it appears that 90% of Builder’s Risk claims are due to water. In many instances, losses occur not only due to the size of the construction project, but due to the stage of project completion – typically around 75-85% completion. When the construction project gets to the point where the site is provided with water, the losses occur.

1. The leading causes of water losses during construction are defective fixtures and faulty workmanship:

Failure to test systems prior to turning the water on can lead to plumbing failure, sprinkler systems malfunction, etc.

2. The rising number of natural disasters and weather is also a key contributor:

For example, our team has seen weather-related losses that affect the completion of the project due to temporary or unfinished roofing system, incomplete exterior envelope, unfinished roughing, or improper connection of drain lines to main drain lines. Our team has seen more water damage in habitational projects than on civil or municipal work due to the presence of plumbing.

How does the market respond?

We have noticed a general market increase in deductibles from $250k or $500k. As result of water damage loss trends and the increased costs associated with repairs, carriers look for solutions to mitigate these exposures. This is specifically true for flooding events which are increasing in number and are not following predictable or historical weather patterns. Carriers are looking to manage deployed flood capacity through the implementation of higher deductibles and smaller flood sublimits as they have done in the Excess & Surplus markets with success.

However, this leaves Owners and General Contractors to accept the additional exposure creating complications and increased costs for financing and lending terms. As a result, there is an emerging tension in the construction market between insurance carriers and their construction clients. Well-resourced Owners and Contractors are looking to preemptively mitigate flood risks throughout the phases of a project. This remains a work in progress and will be interesting to see what emerges.

Interior water damage losses are being addressed by carriers through the implementation of much higher water damage deductibles. Since the root cause of many of these losses is negligence of a subcontractor i.e. plumber, and/or mechanical contractors, these subcontractors are additional insureds in a Builder’s Risk policy form. This policy is considered as the primary policy for the project unless a loss is otherwise excluded.

Solutions – A potential solution to address the frequency of these claims would be for the General Contractor to implement clauses with their subcontractors to transfer a portion of the risk of loss back to them in the event of a determination of faulty workmanship or negligence. Our team has seen many instances where the General Contractor post loss offsets their water damage exposure by collecting their water damage deductible from the subcontractor and passing the remainder of the claim off to the insurance markets. We believe a risk of loss provision for the subcontractors could result in better construction practices by subcontractors who would be more invested in avoiding losses.

Finally, as in flood losses, interior water damage losses are also being mitigated by Owners and Contractors through the implementation of water sensors and monitoring to contain the impact water damage arising from these occurrences. We have only started to see the impacts of these mitigation techniques and their current cost makes their widespread adoption unlikely. Engle Martin’s Specialty Loss Group takes pride in monitoring these trends to ensure the best possible claim outcome for our clients.

If you would like more information about how Engle Martin’s Specialty Loss Group can support your needs, contact info@englemartin.com.